The truth is slowly starting to emerge about investing. What used to be available for those that had the good sense to seek out resources like the Motley Fool is becoming more widespread. Jon Oliver recently threw his weight behind what those behind the scenes have always known. We were taught this in our finance classes in the MBA program but were aware that it’s not common knowledge. If it was common knowledge the major investment firms would start losing money on advising fees. The number one rule of investing is: never invest in single stocks (alone). The second rule of investing is: you can’t beat the market (unless you’re an extreme statistical outlier like Warren Buffet or you cheat).

Knowing this, the best performing portfolio is generally one that contains mutual funds, or mirrors mutual fund stocks. Diversifying these funds based on volatility is best. (Mutual funds are a grouping of stocks that are intended to mirror the performance of the market as a whole while containing enough diversity to safeguard against losses) If that sounds like your retirement account, it’s because it is. Nobody wants to lose money in their retirement account over time, so it’s managed to meet the market. What nobody tells you is that to do anything else is riskier than you might think.

I’m assuming most of my family/friends already know all this, but for any that do not I’m providing personal proof of this abstract concept.

I decided to invest a little money into the “motif” format last year. Motif lets you arrange your own package of stocks (which they call “motifs”), which can then be used by other members (which gives you a little kick-back). I didn’t really do it because it was a snazzy new startup. I was just tired of dealing with TDAmeritrade et al, who make trading and putting together a portfolio nearly impossible for someone (me) who wants to set it and forget it.

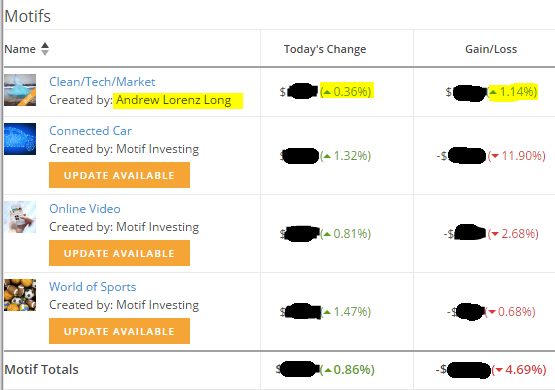

I purchased three of their recommended professionally built motifs and created one of my own. I based the picks in my motif on a somewhat capricious method of picking companies I like/use and/or believe are good for the environment.

After a few weeks, last summer’s mini-recession on wall street took hold and my account is still in the negative more than a year later. However, the performance difference between the funds arranged by the “professionals” and myself is striking. The only fund I own that isn’t still in the red… is the one I created. Me. Not a financial genius. Not interested in day trading. Not the kind that attends shareholder meetings or reads prospectuses (prospecti?).

So why didn’t I follow my own rules? Maybe a latent desire to gamble since I don’t know how to play poker, blackjack, or any of the professional gamblers vices. I don’t know, really, maybe just stupidity?

In any case, I plan on smarting up and trading into mutual funds when/if my portfolio becomes positive again.

In the interest of full disclosure: my investments have provided enough dividends that after adding in my cash balance my account is actually already in the green. However, many stocks aren’t required to give dividends, so counting on those in the future to make up for losses would be foolish. Hopefully one day I’ll grow out of doing foolish things…(with money).

UPDATE (7/20/2016): Again, not just me saying this.